RPR vs. Title Insurance in Alberta Real Estate

When buying or selling a home in Edmonton (or anywhere in Alberta), two important legal tools often come up: the Real Property Report (RPR) and Title Insurance. Both are designed to protect buyers, sellers, and lenders, but they work in very different ways. Understanding the difference will help you know what to expect in your transaction.

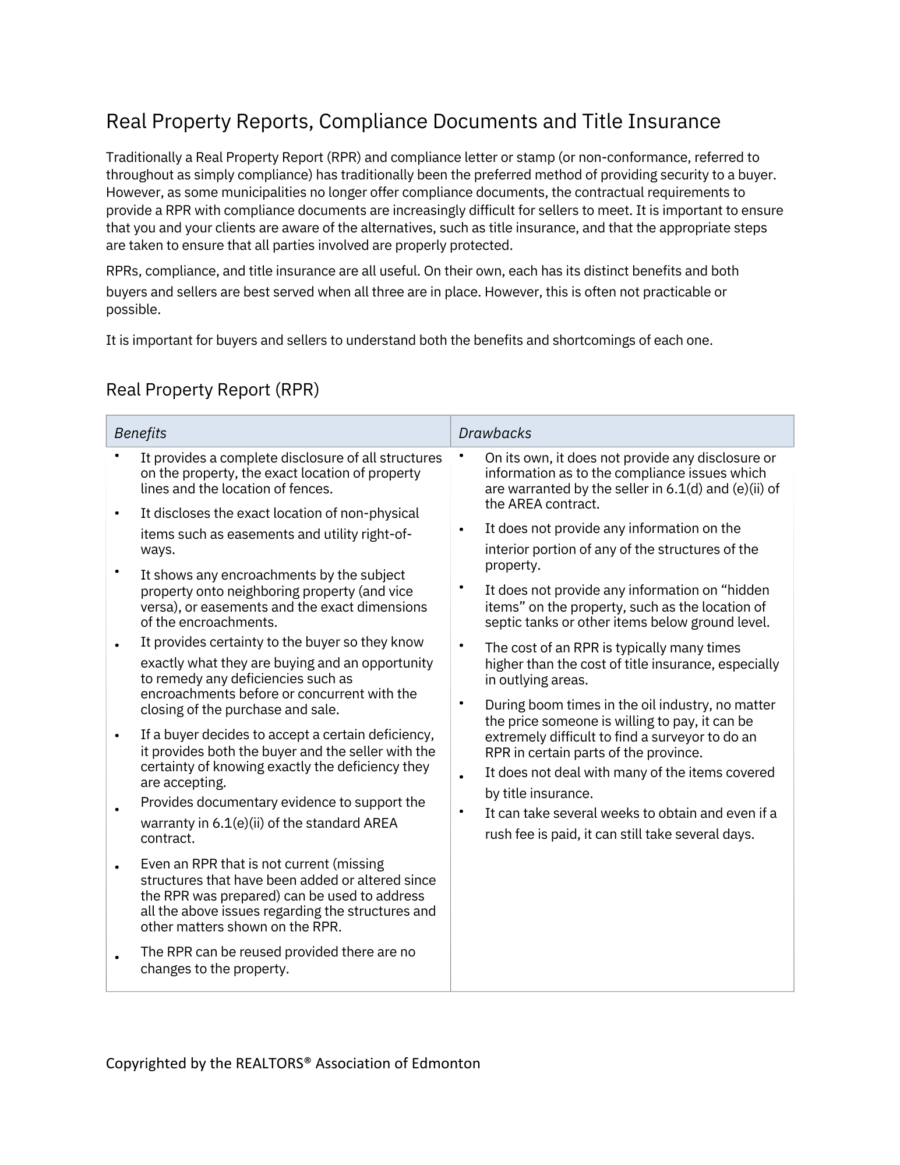

What is a Real Property Report (RPR)?

A Real Property Report is a legal document prepared by an Alberta land surveyor. It shows:

- Property boundaries

- Location of buildings, fences, garages, sheds, and other improvements

- Encroachments (such as a neighbor’s fence crossing the property line)

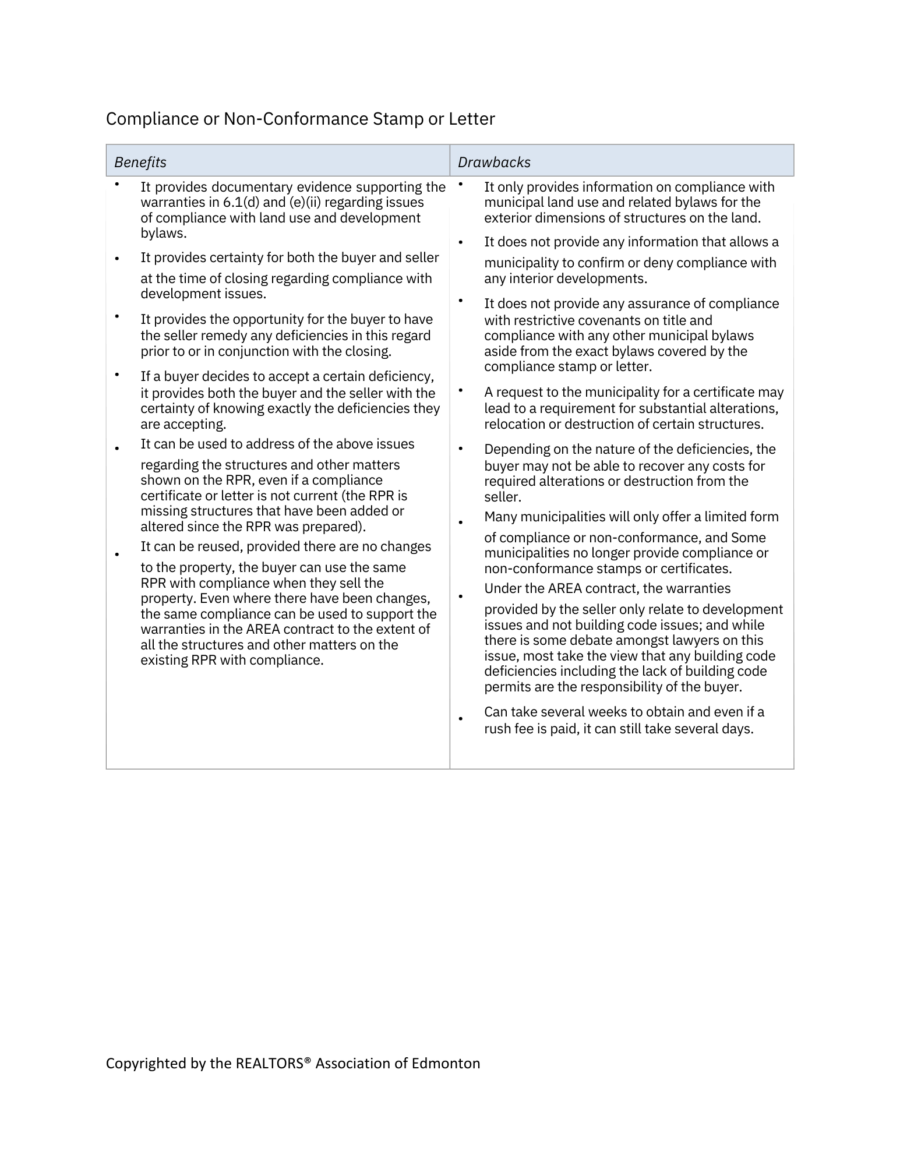

The RPR is reviewed by the municipality to confirm compliance with local bylaws. This process results in a Certificate of Compliance that ensures the property meets zoning regulations.

When Do You Need an RPR?

In most Alberta real estate contracts, the seller is expected to provide an up-to-date RPR with compliance. This gives the buyer and their lender confidence that the property is accurately represented and free of major issues.

Common times an RPR is required:

- When selling a single-family home or duplex

- When adding structures like a deck, garage, or fence that may change compliance

- When a buyer’s lender insists on reviewing it before advancing funds

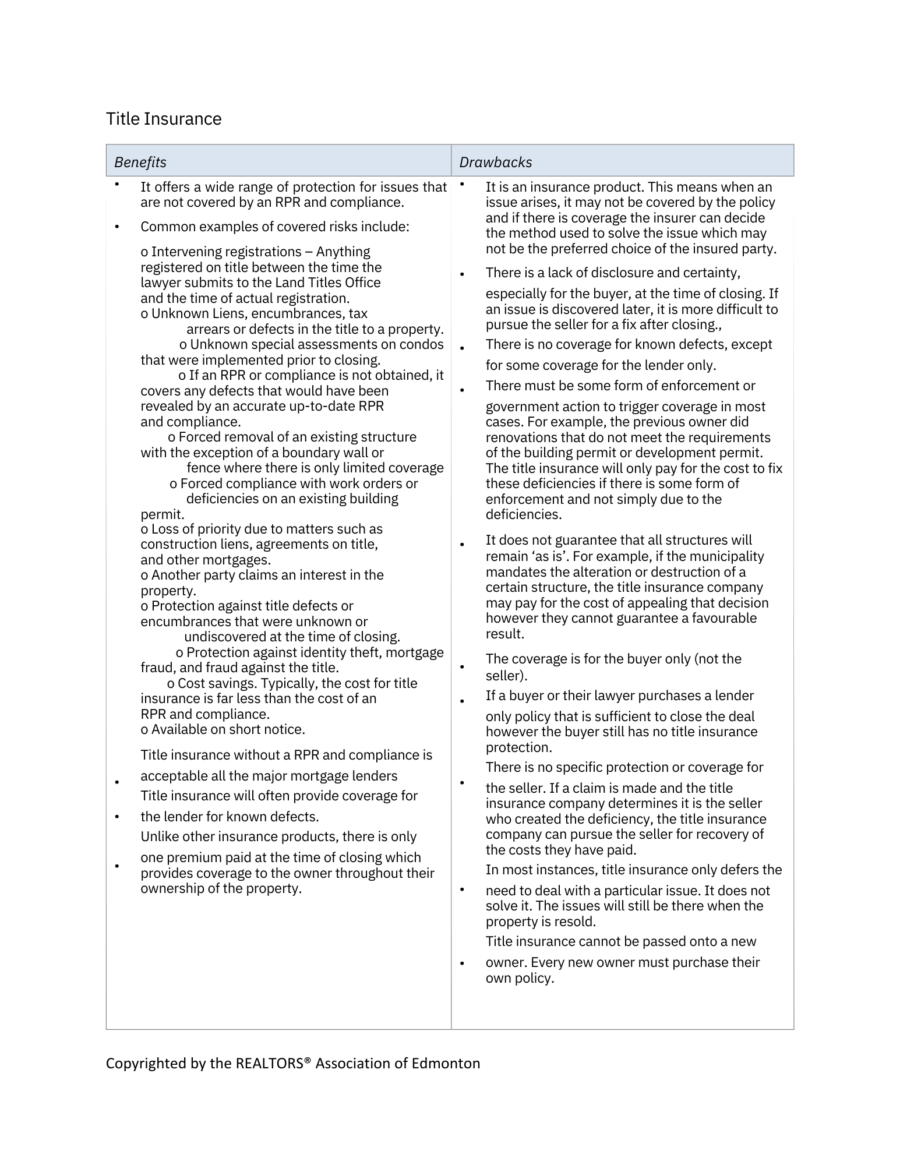

What is Title Insurance?

Title Insurance is an insurance policy that protects buyers and lenders from losses related to defects in the property’s title. It doesn’t involve a survey, but instead offers financial coverage if problems are discovered later.

It can cover issues such as:

- Title fraud or forgery

- Unknown encroachments or easement problems

- Errors in public records

- Zoning issues or building permit defects

- Legal costs if ownership is challenged

When is Title Insurance Used Instead of an RPR?

In Alberta, if the seller cannot provide an updated RPR before closing, title insurance may be negotiated instead. This helps avoid delays while still providing protection to the buyer and lender.

Title insurance is also popular in:

- Condo transactions, where RPRs are not typically used

- Quick closings where updating an RPR would take too long

- Cases where minor encroachments exist that would otherwise prevent compliance

Cost Comparison

- RPR: Typically $500–$800 for a new report, plus $100–$200 for municipal compliance.

- Title Insurance: One-time premium of $200–$400, depending on property value.

Which One is Better?

Neither is “better” — it depends on the situation:

- RPR with compliance offers peace of mind that the property physically complies with municipal rules.

- Title insurance offers financial protection if a problem arises later.

In many transactions, sellers provide the RPR, but buyers or lenders may request title insurance as extra protection.

FAQs

Q: What is an RPR in Alberta real estate?

A Real Property Report (RPR) is a legal survey showing property boundaries, structures, and improvements. It confirms whether the property complies with municipal bylaws.

Q: When is title insurance used instead of an RPR?

Title insurance can be used when an updated RPR is unavailable before closing. It protects against losses from encroachments, defects, or fraud.

Q: Do sellers in Edmonton have to provide an RPR or title insurance?

Most contracts require sellers to provide an up-to-date RPR with compliance. If this isn’t possible, title insurance may be agreed upon instead.

Q: How much does title insurance cost in Alberta?

Title insurance usually ranges from $200–$400 for residential properties, depending on the value of the home.

Q: Can you have both an RPR and title insurance?

Yes, many buyers choose both. The RPR ensures compliance, while title insurance provides extra protection against unexpected title issues.

Next Steps

If you’re preparing to sell your home, I can help review your documents and advise whether an RPR update or title insurance makes sense. Contact me today for guidance.